China's slowdown

Key points

- Chinese growth has already slowed significantly due to slowing exports and a property slump. Growth is likely to slow to 8% in 2009.

- However, a hard landing (ie 5% growth) is unlikely. The global financial turmoil will not have a direct impact on China’s financial system, monetary conditions are now being eased, significant fiscal stimulation is on the way and consumer spending should remain solid.

- The downturn in China, combined with recessions in the US, Europe and Japan, is negative for commodity prices which are unlikely to start recovering until global growth turns back up, probably some time next year.

- Chinese shares are down about 70% from their high. Further falls are possible, but they are now good value from a long-term perspective.

Introduction

China’s economy is now slowing significantly. This note looks at the likely severity of the slowdown and implications for commodity prices and China’s share market.

The Chinese economy is slowing

Evidence that China’s economy has slowed is now overwhelming:

- Growth in real GDP has slowed from a peak of 12.6% (over the year to the June quarter 2007) to 9% over the year to the September quarter this year, its slowest pace in over 5 years.

- Industrial production has slowed from annual growth of around 18% a year ago to 11.4% last month.

- Auto sales fell 2.8% in the year to September, the first fall since 2005.

- China’s average house prices have declined about 4% from their peak in January and home sales are down 42% from a year ago.

- Money supply and loan growth are well below year ago levels.

- There are numerous anecdotes of business failures among east coast exporters.

The slowdown is primarily driven by 3 factors:

- A slowdown in export volumes in response to the US and European slumps.

- A property slump, resulting from policy measures in place since 2004 designed to slow the economy and property development.

- Production restrictions in the Beijing area associated with the Olympics, which have exaggerated recent production weakness.

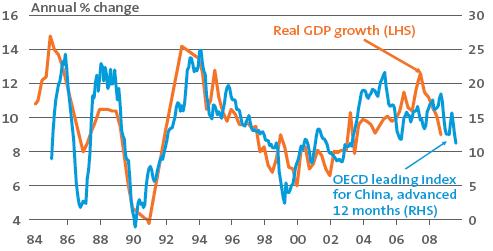

Leading indicators suggest further deceleration is ahead. The OECD’s leading indicator for China suggests a slowdown in growth to around 8%.

China’s growth is slowing with further weakness likely

Source: Thomson Financial, AMP Capital Investors

This is likely to be led by a further slump in export growth to around 10% (from 21% currently) in response to the global slump and a sharp rise in the trade weighted value of the Renminbi. The impact of the property downturn will also feed through to business investment (where property construction accounts for about 25% of fixed asset investment) and consumer confidence.

But why not a hard landing?

While China is slowing significantly, it is unlikely to experience a hard landing. Given China’s potential growth rate of around 8% to 10% and its need to find jobs for roughly ten million rural workers each year, a hard landing would mean growth of around 5%.

- The Chinese banking system appears solid compared to those in the developed world. Loan to valuation ratios have been falling, there are limited linkages to global banks, there is no dependence on foreign capital, there is no confidence crisis and credit availability has only been an issue to the extent that the government has restricted it.

- The Chinese corporate sector is in good shape. Leverage has been falling and the level of retained earnings is high, as is the return on equity. The equity market only accounts for 15% of corporate financing.

- Consumer spending is likely to remain robust. Despite the 70% slump in Chinese shares and falling house prices, consumer spending has actually accelerated recently. Chinese consumers have very high saving rates, are not very geared and only 5% of Chinese households have a significant share exposure. On top of this, the authorities have been trying to boost consumer spending via a range of policies including social security reforms, labour reforms and assistance for rural workers.

Exports have moderated, but retail sales have accelerated

Source: Thomson Financial, AMP Capital Investors

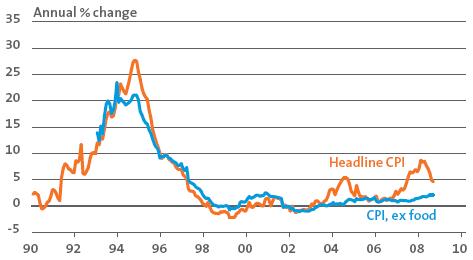

- Monetary conditions are now being eased aggressively with 2 interest rate cuts in less than 2 months. This has been made possible by a sharp fall in inflation. In fact, after years of plus 20% pa investment growth, it is likely that the slump in demand for China’s exports will see deflation become more of an issue as excess capacity starts to build up. With China’s key lending rate at 6.93%, there is plenty of scope for further easing and this is likely to occur soon.

China’s inflation rate has fallen, allowing policy easing

Source: Thomson Financial, AMP Capital Investors

- Fiscal easing is now on the agenda. The government appears set to increase spending on infrastructure related to agriculture, energy, transport and urban development. Increased social spending and increased subsidies for farmers are also likely. There is a lot of room for fiscal stimulus in China as the budget surplus is running around 2% of GDP.

- Policies to specifically boost the property sector are also set to be introduced. These include increased public housing construction, reduced transaction taxes and support for home purchases. Some cities are already moving to stimulate their local property markets.

- Further increases in export tax rebates are also likely.

The Chinese Government has switched its focus from inflation to stabilising and maintaining fast growth. While China’s economy has slowed and is likely to slow further, a hard landing is unlikely.

Furthermore, the current slowdown in China should be seen as cyclical. Structural forces that are driving growth remain very strong. These include strong productivity growth, huge competitive advantages, rapid urbanisation, surging consumer demand and strong investment. With per capita income levels still very low, China’s rapid growth phase has a long way to go, probably several decades.

China’s slowdown will cut into commodity demand

China’s growth is unlikely to collapse, but a slowdown from 12% last year to 8% in 2009 (on top of recessions in the US, Europe and Japan) will cut sharply into commodity demand. Stockpiles of iron ore and coal are already building. It is likely that 2009 will see demand running below supply for several commodities. After sharp falls, commodity prices (and resource shares) are currently very oversold and are due for a decent short-term rally, but the unfolding slump in global growth (made worse by slower growth in China) suggests they are yet to see their cyclical bottom. Commodity prices normally lag the economic cycle and are only likely to resume a long-term bull market once it becomes clear that global growth is heading higher. This is unlikely for at least another 6 to 9 months. For Australia, this suggests falling terms of trade and softer export demand growth.

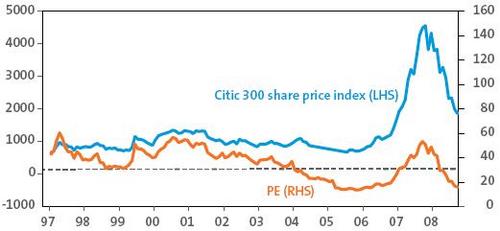

What about the Chinese share market?

From its high in October last year to its recent low, the Chinese share market has fallen nearly 70%. This has restored value to Chinese shares, with the price to earnings multiple falling from over 50 times to 16 times, which is below the long-term average.

Chinese shares are cheap again

Source: Thomson Financial. AMP Capital Investors

Additionally, the liquidity cycle for shares is becoming more positive with easier monetary conditions. The government is also becoming active in trying to boost the market with moves to abolish stamp duty on share purchases, allow margin trading, encourage buybacks and delay the sale of non-tradeable shares. Investor sentiment in China seems to have reached the despair often seen around bear market lows. While it is too early to be confident that the market has bottomed, particularly with earnings estimates still falling and investor panic feeding on itself, Chinese shares look attractive from a long-term perspective.

Concluding comments

China’s economy has slowed from over 12% growth to 9% and is likely to slow even further. On top of the recession now unfolding in developed countries, this will cut into commodity demand over the year ahead, suggesting commodity prices may fall further. However, China’s downturn is unlikely to turn into a hard landing and does nothing to detract from China’s positive long-term outlook which, if anything, is being enhanced in a relative sense by the debilitating problems faced by the US.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591) (AFSL 232497) makes no representation or warranty as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.