The Reserve Bank grows some teeth

Our central bank has not been winning many public relations awards in recent weeks. There appears to have been a distinct change in strategy with the Reserve Bank now using its public comments and press releases to add to the efficacy of its monetary policy settings.

Press releases accompanying the change in monetary policy in February and March both confirmed the central bank’s view that a “significant” slowing in demand was necessary if inflation was to be brought under control. Contrast this to the November monetary policy announcement when the far gentler language of demand needing to “moderate” was used as the rationale for higher interest rates.

The change in the approach of the Reserve Bank received mainstream media attention last month when Governor Glenn Stevens commented, “I think that's just life”, when discussing the approach of banks in raising mortgage interest rates by more than the increase in the cash interest rate.

The need for a change in approach

Although a change in approach may have not won many friends, there was a need for change if the Reserve Bank was to be more successful at influencing economic outcomes.

Between May 2002 and November 2007, there were 10 consecutive increases in interest rates of 0.25%. Despite the regularity of these increases, there was very little evidence that any of these increases had any real impact on demand within the economy. Arguably, rising interest rates may have stopped the economy from overheating, however, demand and consumer confidence remained extremely buoyant over this period.

Consumers and business appeared to be able to take higher interest rates in their stride. Each increase was not significant in its own right and was generally expected well before it was announced. There was therefore little “shock value” in the policy decisions and as a result little change in behaviour followed. The “frog in boiling water” analogy could aptly describe the economy’s reaction to the gradual heating up of monetary policy over this period.

With underlying inflation starting to move outside the Reserve Bank’s target range in late 2007, clearly a change in strategy was needed. The Board of the Reserve Bank admitted as much with the minutes of the February 2008 Monetary Policy Meeting of the Board stating that:

“there was a case for the Board to send a stronger signal of its intention to act as necessary to reduce inflation”.

As the minutes of this meeting also suggest, the board of the Reserve Bank came very close to implementing a 0.5% increase interest rates as a way to achieve this “stronger signal.” Instead, they appear to be signalling via a change in communication style.

The impact of monetary policy change

The main economic variable being targeted by central banks when they tighten monetary policy is the level of consumer spending. It is consumer spending that forms the largest component of aggregate demand within the economy, and it will therefore have the largest impact of any inflationary demand pressures that exist within the economy.

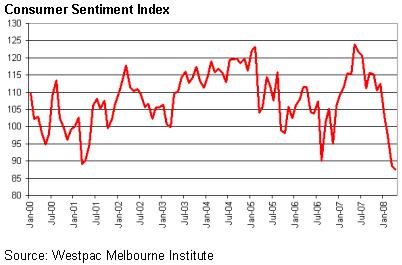

A leading indicator of consumer spending is the level of consumer confidence. When consumers are confident about their future financial prospects they will tend to spend more. A long term measure of consumer confidence is provided by the Westpac Melbourne Institute Index of Consumer Sentiment. As shown on the chart below, this Index has shown a significant fall over the past 2 months, with consumer confidence now at its lowest level since mid 1993.

Being cruel to be kind

Hence, whereas the 10 previous changes in monetary policy failed to bring about any significant change in consumer sentiment, the latest round of increases appears to have had immediate effect. Admittedly, the Reserve Bank can’t take all the credit for the change; weaker equity markets and continued gloomy overseas economic news would have also contributed to the outcome. However, it would appear that communicating in a fashion that portrayed an attitude that inflation would be controlled no matter how high interest rates had to go, has resulted in a more effective outcome.

Whilst raising the ire of the public, particularly those with mortgages, the tougher rhetoric of the central bank could have averted the need for further and larger increases in interest rates.

Brad Matthews, Hillross Economist